Posts by pwsadmin

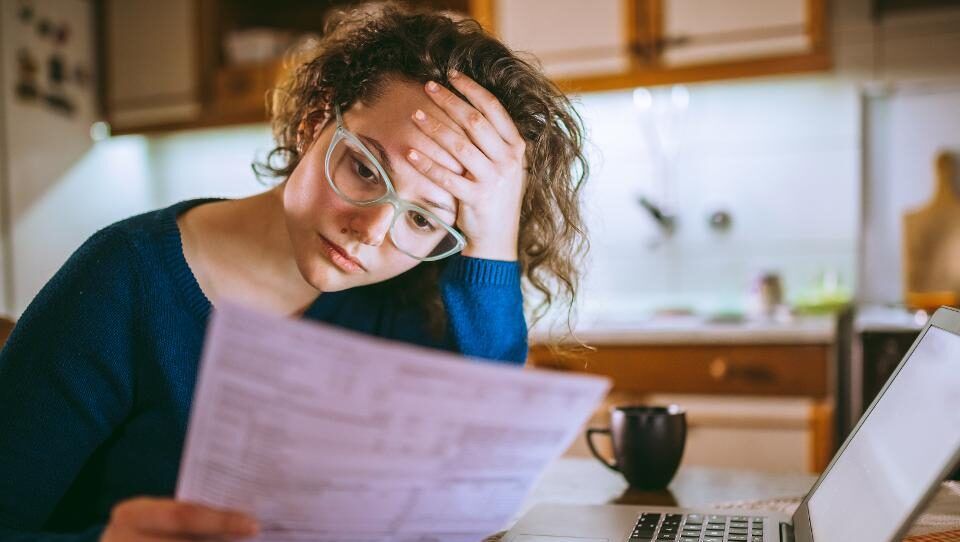

End of Federal Student Loan Forbearance puts Borrowers under Significant Stress

As federal student loan forbearance concludes, a new survey by Achieve reveals that nearly half of borrowers are under significant stress. The forbearance, initiated in March 2020, aimed to reduce financial pressures during the COVID-19 pandemic. Yet, as payments are set to restart in October, borrowers face an economic backdrop of escalating inflation, high interest…

Read MoreStudent Loan Deferment comes to an End

In March 2020, during the pandemic, the government implemented a pause on student loan payments, both deferring the payment of student loans and halting the accrual of interest. It was projected by higher education expert Mark Kantrowitz that this pause on student loan payments saved the average borrower about $5000 in interest. After a three-year…

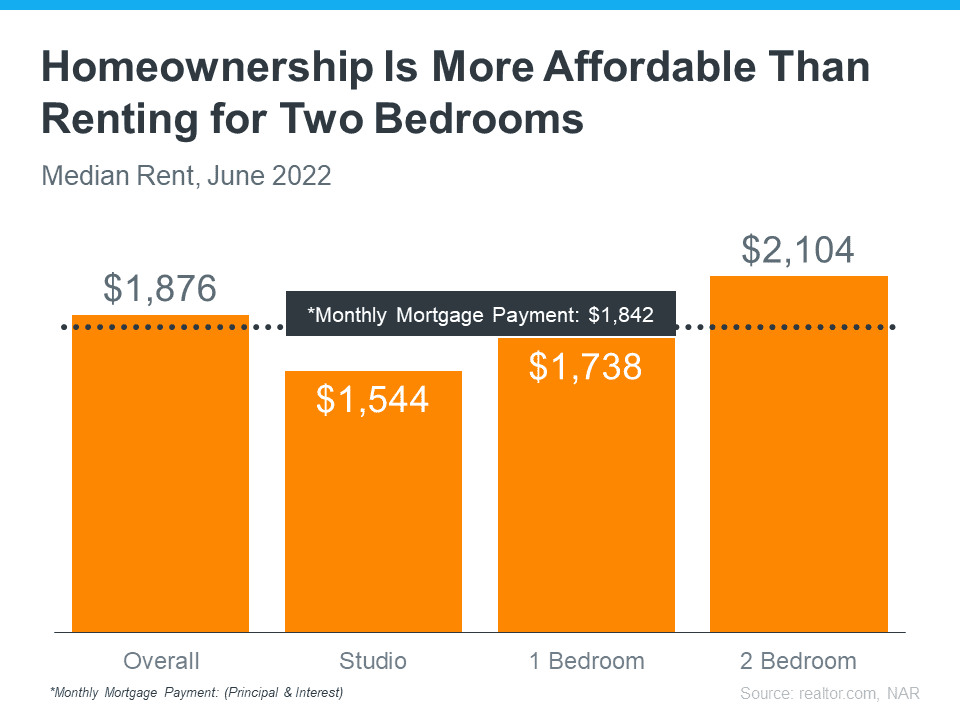

Read MoreBuying a Home May Make More Financial Sense Than Renting One

If rising home prices leave you wondering if it makes more sense to rent or buy a home in today’s housing market, consider this. It’s not just home prices that have risen in recent years – rental prices have skyrocketed as well. As a recent article from realtor.com says: “The median rent across the 50…

Read MoreRefinance To Pay Off Debt: Is It The Right Solutions For You?

Whether it’s credit card debt, student loan debt, medical bills, or anything else, owing a large amount of money is no fun at all. Especially in a market seeing high inflation. Fortunately, if you own your home, you may be able to refinance to pay off debt. It’s not always the best solution for everyone…

Read MoreWhen Is the Best Time to Refinance Your Mortgage Again?

Should you refinance again? Homeowners under a mortgage loan will probably ask this question a few times throughout their contracts. This is a common question from borrowers and comes with a few considerations. In 2020, the rates plunged to an all-time low record. The situation prompted people to refinance their mortgages to reposition their rates…

Read MoreUnderstanding the First Mortgage vs Second Mortgage

When planning to buy a house, potential homeowners usually borrow money from lenders. If you plan to do this anytime soon, it would be helpful to learn about the different types of mortgage you can get. That way, you might understand their good points and bad points. This article will tell you how the first…

Read MoreWhat You Need to Know About Getting a USDA Loan

Are you planning to apply for USDA loans? Here are things you need to know about. First, USDA loans are backed by the U.S. Department of Agriculture. Second, this type of loan is part of the department’s Rural Development Guaranteed Housing Loan program that is available for individuals who have low-to-average income. Finally, a USDA…

Read MoreTips and Tricks on How to Get an FHA 203k Loan Approved

Are you one of the many Americans dreaming of having their own home? Have you knocked on every bank door for a housing loan, only to be turned down? Are you willing to put in the effort on a fixer-upper, but you can’t afford to both buy and renovate it? Then consider applying for an…

Read MoreWhat You Need to Know About Construction Loans

Are you having trouble finding the dream home that you’d want to buy? Perhaps you’re wondering if building a house or renovating your current one makes more sense for you and if you can take a housing loan for it, too. You should know that the process of borrowing money for home construction is different…

Read More